Python for Quant Finance¶

Conquering the Analytics Space

Dr. Yves J. Hilpisch | The Python Quants GmbH

analytics@pythonquants.com | www.pythonquants.com

PyData New York City, 22. November 2014

The Python Language¶

Black-Scholes-Merton (1973) SDE of geometric Brownian motion. The "Hello World example of Quant Finance."

$$ dS_t = rS_tdt + \sigma S_t dZ_t $$

Monte Carlo simulation: draw $I$ standard normally distributed random number $z_t^i$ and apply them to the following by Euler disctretization scheme to simulate $I$ end values of the GBM:

$$ S_{T} = S_0 \exp \left(\left( r - \frac{1}{2} \sigma^2\right) T + \sigma \sqrt{T} z_T \right) $$

Latex description of Euler discretization.

S_T = S_0 \exp (( r - 0.5 \sigma^2 ) T + \sigma \sqrt{T} z_T)

Python implementation of algorithm.

from pylab import *

S_0 = 100.; r = 0.01; T = 0.5; sigma = 0.2

z_T = standard_normal(10000)

S_T = S_0 * exp((r - 0.5 * sigma ** 2) * T + sigma * sqrt(T) * z_T)

Again, Latex for comparison:

S_T = S_0 \exp (( r - 0.5 \sigma^2 ) T + \sigma \sqrt{T} z_T)

Interactive visualization of simulation results.

%matplotlib inline

pyfig = figure()

hist(S_T, bins=40);

grid()

The Python Ecosystem¶

The Python ecosystem can be considered one of the major competitive advantages of the language.

- IPython (Notebook)

- NumPy (fast, vectorized array operations)

- SciPy (collection of scientific classes/functions)

- pandas (times series and tabular data)

- PyTables (hardware-bound IO operations)

- scikit-learn (machine learning algorithms)

- statsmodels (statistical classes/functions)

- xlwings (Python-Excel integration)

Integration – No "Either Or" with Python

Python integrates pretty well with almost any other language used for scientific and financial computing.

- C/C++ (natively)

- Julia (IPython)

- JavaScript (IPython)

- R (IPython/rpy2)

- Matlab (NumPy)

- ...

Example: Statistics with R¶

We analyze the statistical correlation between the EURO STOXX 50 stock index and the VSTOXX volatility index.

First, reading the EURO STOXX 50 & VSTOXX data.

import pandas as pd

es = pd.HDFStore('data/SX5E.h5', 'r')['SX5E']

vs = pd.HDFStore('data/V2TX.h5', 'r')['V2TX']

es['SX5E'].plot(figsize=(9, 6))

<matplotlib.axes.AxesSubplot at 0x10f9d5f10>

Generating log returns with Python and pandas.

import numpy as np

# log returns for the major indices' time series data

datv = pd.DataFrame({'SX5E' : es['SX5E'], 'V2TX': vs['V2TX']}).dropna()

rets = np.log(datv / datv.shift(1)).dropna()

ES = rets['SX5E'].values

VS = rets['V2TX'].values

Bridging to R from within IPython Notebook and pushing Python data to the R run-time.

%load_ext rpy2.ipython

The rpy2.ipython extension is already loaded. To reload it, use: %reload_ext rpy2.ipython

%Rpush ES VS

Plotting with R in IPython Notebook.

%R plot(ES, VS, pch=19, col='blue'); grid(); title("Log returns ES50 & VSTOXX")

Linear regression with R.

%R c = coef(lm(VS~ES))

<FloatVector - Python:0x115c647e8 / R:0x10bd931c8> [-0.000074, -2.752754]

%R print(summary(lm(VS~ES)))

Call:

lm(formula = VS ~ ES)

Residuals:

Min 1Q Median 3Q Max

-0.32412 -0.02188 -0.00213 0.02015 0.53675

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -7.416e-05 6.169e-04 -0.12 0.904

ES -2.753e+00 4.078e-02 -67.50 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.03905 on 4006 degrees of freedom

Multiple R-squared: 0.5321, Adjusted R-squared: 0.532

F-statistic: 4556 on 1 and 4006 DF, p-value: < 2.2e-16

Regression line visualized.

%R plot(ES, VS, pch=19, col='blue'); grid(); abline(c, col='red', lwd=5)

Pulling data from R to Python and using it.

%Rpull c

plt.figure(figsize=(9, 6))

plt.plot(ES, VS, 'b.')

plt.plot(ES, c[0] + c[1] * ES, 'r', lw=3)

plt.grid(); plt.xlabel('ES'); plt.ylabel('VS')

<matplotlib.text.Text at 0x116005690>

If you want to have it nicer, interactive and embeddable anywhere – use plot.ly

import plotly.plotly as ply

ply.sign_in('yves', 'token')

Let us generate a plot with fewer data points.

pyfig = plt.figure(figsize=(9, 6)); n = 100

plt.plot(ES[:n], VS[:n], 'b.')

plt.plot(ES[:n], c[0] + c[1] * ES[:n], 'r', lw=3)

plt.grid(); plt.xlabel('ES'); plt.ylabel('VS')

<matplotlib.text.Text at 0x11623f510>

Only single line of code needed to convert matplotlib plot into interactive D3 plot.

ply.iplot_mpl(pyfig) # convert mpl plot into interactive D3

Example: Working with Julia¶

Julia is, for example, often faster for iterative function formulations. As an example, consider the Fibonacci sequence.

# quite slow in Python

def fib_rec(n):

if n < 2:

return n

else:

return fib_rec(n - 1) + fib_rec(n - 2)

%time fib_rec(35)

CPU times: user 2.87 s, sys: 29 ms, total: 2.9 s Wall time: 2.85 s

9227465

%%julia

# much faster in Julia

fib_rec(n) = n < 2 ? n : fib_rec(n - 1) + fib_rec(n - 2)

@elapsed fib_rec(35)

fib_rec (generic function with 1 method) 0.072275267

For comparison, an iterative function implementation.

# iterative version in Python

def fib_it(n):

x,y = 0, 1

for i in xrange(1, n + 1):

x, y = y, x + y

return x

%time fn = fib_it(1000000) # with 1,000,000

CPU times: user 9.6 s, sys: 32 ms, total: 9.64 s Wall time: 9.41 s

%%julia

# iterative version in Julia

function fib_it(n)

x, y = (0,1)

for i = 1:n

x, y = (y, x + y)

end

return x

end

fib_it(5) # initial call

@elapsed fib_it(10000000) # with 10,000,000

fib_it (generic function with 1 method) 5 0.005006169

For final comparison, the dynamically compiled Python version with Numba.

import numba

fib_nb = numba.jit(fib_it)

%timeit fib_nb(10000000) # with 10,000,000

100 loops, best of 3: 4.91 ms per loop

Performance – Numerical Algorithms

Finance algorithms are loop-heavy; Python loops are slow; Python is too slow for finance.

def counting_py(N):

s = 0

for i in xrange(N):

for j in xrange(N):

s += int(cos(log(1)))

return s

N = 2000

%time counting_py(N)

# memory efficient but slow

CPU times: user 10.7 s, sys: 782 ms, total: 11.5 s Wall time: 10.9 s

4000000

First approach: vectorization with NumPy.

%%time

arr = ones((N, N))

print int(sum(cos(log(arr))))

4000000 CPU times: user 109 ms, sys: 49.4 ms, total: 158 ms Wall time: 201 ms

arr.nbytes # much faster but NOT memory efficient

32000000

Second approach: dynamic compiling with Numba.

import numba

counting_nb = numba.jit(counting_py)

%time counting_nb(N)

# some overhead the first time

CPU times: user 177 ms, sys: 56.5 ms, total: 234 ms Wall time: 367 ms

4000000

%timeit counting_nb(N)

# even faster AND memory efficient

10 loops, best of 3: 56.7 ms per loop

Performance – Hardware-bound IO

Hardware-bound IO operations are standard for Python.

%time one_gb = standard_normal((12500, 10000))

one_gb.nbytes

# a giga byte worth of data

CPU times: user 5.66 s, sys: 435 ms, total: 6.1 s Wall time: 7.11 s

1000000000

%time save('one_gb', one_gb)

CPU times: user 54.9 ms, sys: 1.77 s, total: 1.82 s Wall time: 2.58 s

!ls -n one_gb*

-rw-r--r-- 1 501 20 1000000080 21 Nov 20:50 one_gb.npy

!rm one_gb*

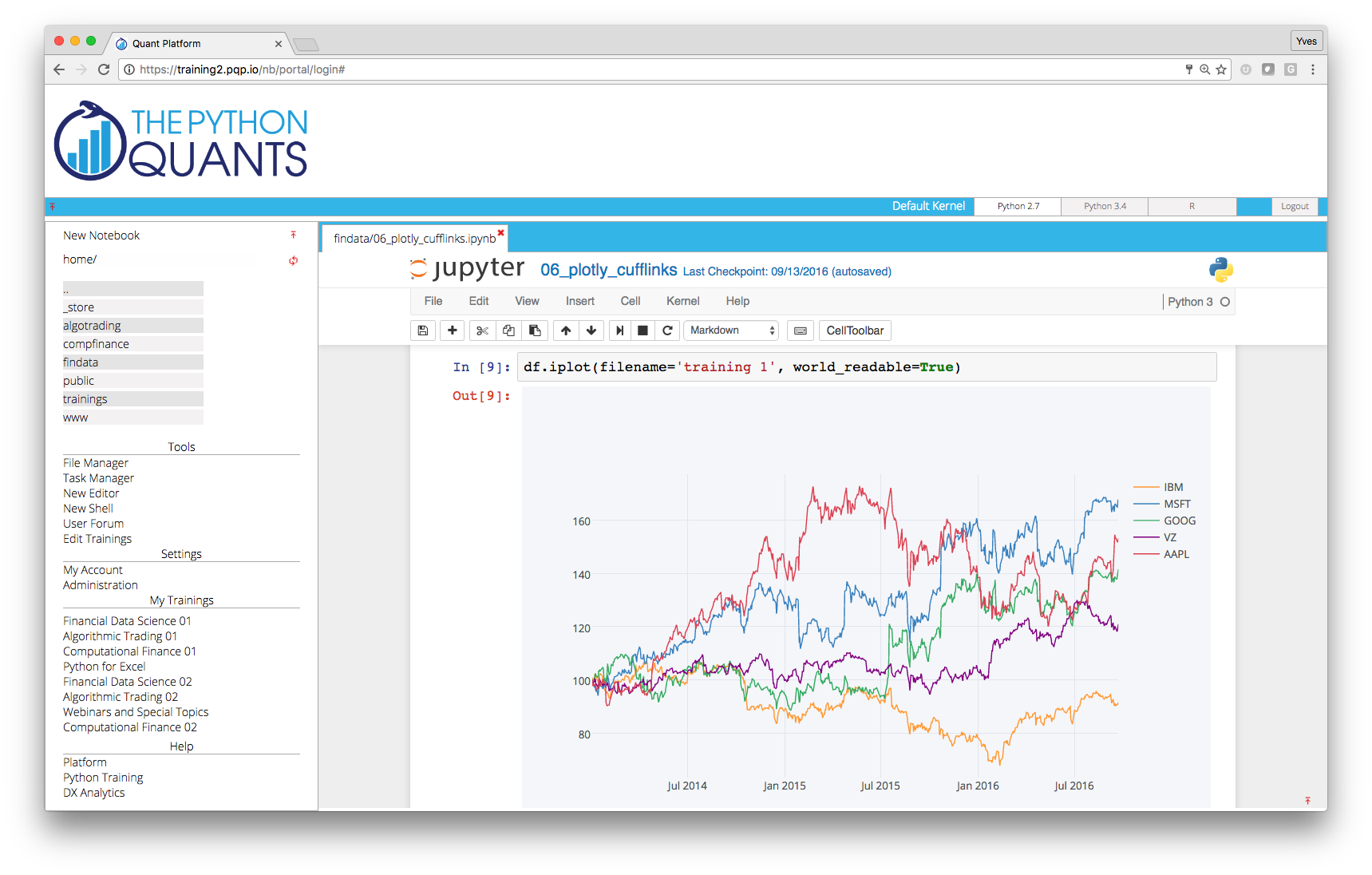

Python Quant Platform¶

Integrating it all and adding collaboration and scalability (http://quant-platform.com).

At the moment, the Python Quant Platform comprises the following components and features:

- IPython Notebook: interactive data and financial analytics in the browser with full Python integration and much more (cf. IPython home page).

- IPython Shell, Python Shell, System Shell: all you typically do on the (local or remote) system shell (Vim, Git, file operations, etc.)

- Anaconda Python Distribution: complete Python stack for financial, scientific and data analytics workflows/applications (cf. Anaconda page); you can easily switch between Python 2.7 and 3.4.

- R Stack: for statistical analyses, integrated via

rpy2and IPython Notebook - Julia: the "high-level, high-performance dynamic programming language for technical computing"

- DX Analytics: our library for advanced financial and derivatives analytics with Python based on Monte Carlo simulation.

- File Manager: a GUI-based File Manager to upload, download, copy, remove, rename files on the platform.

- Chat/Forum: there is a simple chat/forum application available via which you can share thoughts, documents and more.

- Collaboration: the platform features user/group administration as well as file sharing via public folders.

- Linux Server: the platform is powered by Linux servers to which you have full shell access.

- Deployment: the platform is easily scalable since it is cloud-based and can also be easily deployed on your own servers (via Docker containers).

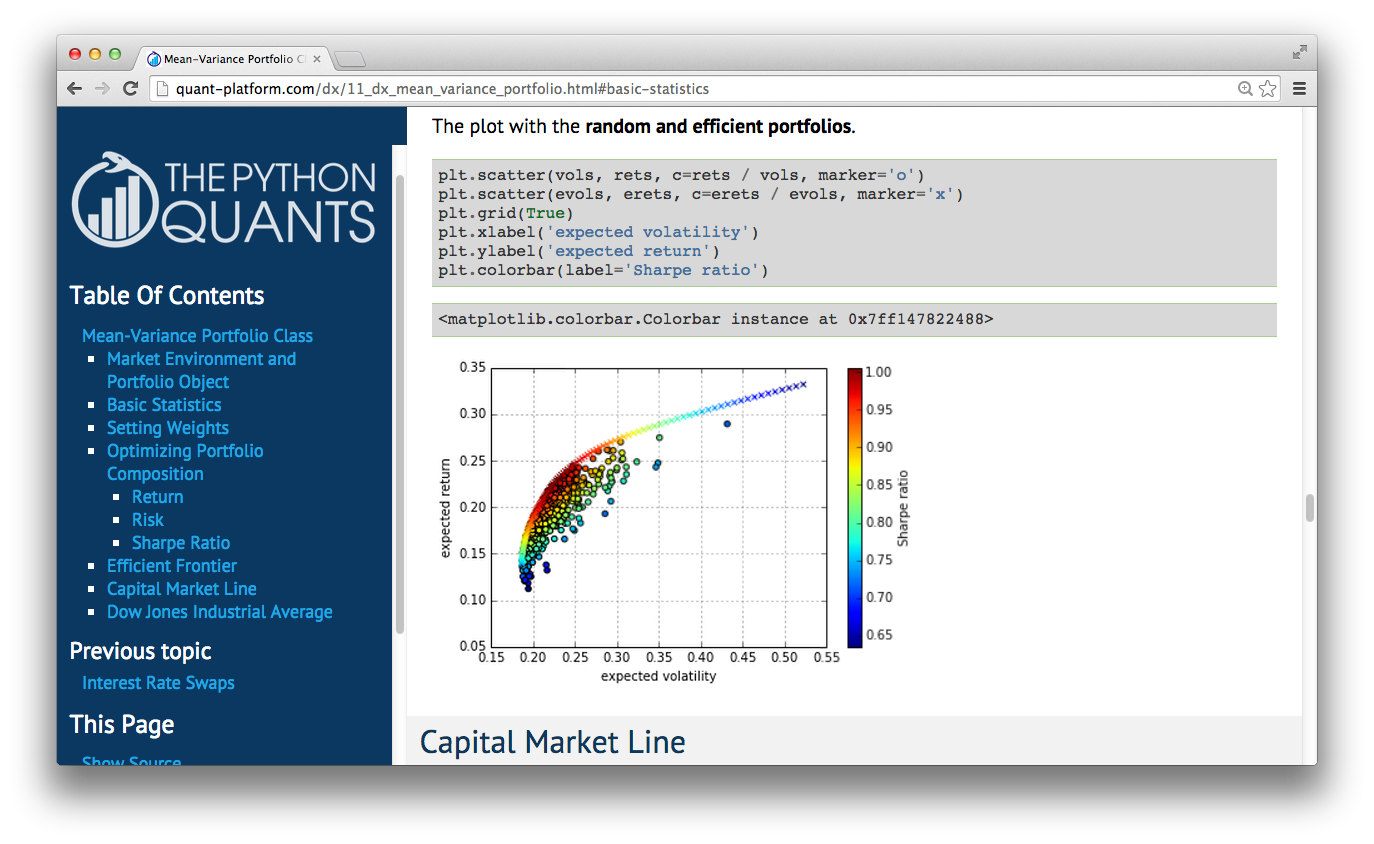

DX Analytics¶

DX Analytics is a Python library for advanced derivatives and risk analytics. Just recently open sourced (cf. http://dx-analytics.com, cf. http://github.com/yhilpisch/dx)

Why DX Analytics? A brief History.¶

Important research milestones (I), from a rather personal perspective.

- Bachelier (1900) – Option Pricing with Arithmetic Brownian Motion

- Einstein (1905) – Rigorous Theory of Brownian Motion

- Samuelson (1950s) – Systematic Approaches to Option Pricing

- Black Scholes Merton (1973) – Geometric Brownian Motion, Analytical Option Pricing Formula

- Merton (1976) – Jump Diffusion, Option Pricing with Jumps

- Boyle (1977) – Monte Carlo for European options

- Cox Ross Rubinstein (1979) – Binomial Option Pricing

Important research milestones (II), from a rather personal perspective.

- Harrison Kreps Pliska (1979/1981) – General Risk-Neutral Valuation, Fundamental Theorem of Asset Pricing

- Cox Ingersoll Ross (1985) – Intertemporal General Equilibrium, Short Rates with Square-Root Diffusion

- Heston (1993) – Stochastic Volatility, Fourier-based Option Pricing

- Bates (1996) – Heston (1993) plus Merton (1976)

- Bakshi Cao Chen (1997) – Bates (1996) plus Cox Ingersoll Ross (1985)

- Carr Madan (1999) – Using Fast Fourier Transforms for Option Pricing

- Longstaff Schwartz (2001) – Monte Carlo for American Options

- Gamba (2003) – Monte Carlo for (Complex) Portfolios of Interdependent Options

DX Analytics leverages the experience of using Python for derivatives analytics since about 10 years.

- Ph.D. research – felt in love with Harrison-Kreps-Pliska general valuation approach

- Visixion (The Python Quants) foundation in 2004 – first steps with Python & Monte Carlo simulation

- DEXISION prototyping from 2007 – using Python to build the first prototype

- DEXISION analytics suite from 2009 until today – using Python and Web technologies to provide analytics as a service

- Derivatives Analytics with Python 2011-2014 – writing a book based on university lectures and Python experience (upcoming at Wiley Finance)

- Python for Finance 2013-2014 – wiriting a book teaching Python for finance (explaining basic DX architecture)

- DX Analytics since QIV 2013 – putting all lessons learned together to write a new, concise Python library

You can register for a PQP trial (incl. DX Analytics) here http://trial.quant-platform.com.

The Quickstart¶

This brief section illustrates---without much explanation---the usage of the DX Analytics library. It models two risk factors, two derivatives instruments and values these in a portfolio context.

import dx

import datetime as dt

import pandas as pd

The first step is to define a model for the risk-neutral discounting.

r = dx.constant_short_rate('r', 0.01)

We then define a market environment containing the major parameter specifications needed,

me_1 = dx.market_environment('me', dt.datetime(2015, 1, 1))

me_1.add_constant('initial_value', 100.)

# starting value of simulated processes

me_1.add_constant('volatility', 0.2)

# volatiltiy factor

me_1.add_constant('final_date', dt.datetime(2016, 6, 30))

# horizon for simulation

me_1.add_constant('currency', 'EUR')

# currency of instrument

me_1.add_constant('frequency', 'W')

# frequency for discretization

me_1.add_constant('paths', 10000)

# number of paths

me_1.add_curve('discount_curve', r)

# number of paths

Next, the model object for the first risk factor, based on the geometric Brownian motion (Black-Scholes-Merton (1973) model).

gbm_1 = dx.geometric_brownian_motion('gbm_1', me_1)

Some paths visualized.

pdf = pd.DataFrame(gbm_1.get_instrument_values(), index=gbm_1.time_grid)

%matplotlib inline

pdf.ix[:, :10].plot(legend=False)

<matplotlib.axes.AxesSubplot at 0x10ad71790>

Second risk factor with higher volatility. We overwrite the respective value in the market environment.

me_2 = dx.market_environment('me_2', me_1.pricing_date)

me_2.add_environment(me_1) # add complete environment

me_2.add_constant('volatility', 0.5) # overwrite value

gbm_2 = dx.geometric_brownian_motion('gbm_2', me_2)

pdf = pd.DataFrame(gbm_2.get_instrument_values(), index=gbm_2.time_grid)

pdf.ix[:, :10].plot(legend=False)

<matplotlib.axes.AxesSubplot at 0x10b132450>

Based on the risk factors, we can then define derivatives models for valuation. To this end, we need to add at least one (the maturity), in general two (maturity and strike), parameters to the market environments.

me_opt = dx.market_environment('me_opt', me_1.pricing_date)

me_opt.add_environment(me_1)

me_opt.add_constant('maturity', dt.datetime(2016, 6, 30))

me_opt.add_constant('strike', 110.)

The first derivative is an American put option on the first risk factor gbm_1.

am_put = dx.valuation_mcs_american_single(

name='am_put',

underlying=gbm_1,

mar_env=me_opt,

payoff_func='np.maximum(strike - instrument_values, 0)')

Let us calculate a Monte Carlo present value estimate and estimates for the major Greeks.

am_put.present_value()

15.019

am_put.delta()

-0.539

am_put.vega()

57.1

The second derivative is a European call option on the second risk factor gbm_2.

eur_call = dx.valuation_mcs_european_single(

name='eur_call',

underlying=gbm_2,

mar_env=me_opt,

payoff_func='np.maximum(maturity_value - strike, 0)')

Valuation and Greek estimation for this option.

eur_call.present_value()

20.659128

eur_call.delta()

0.8459

eur_call.vega()

48.3196

In a portfolio context, we need to add information about the model class(es) to be used to the market environments of the risk factors.

me_1.add_constant('model', 'gbm')

me_2.add_constant('model', 'gbm')

To compose a portfolio consisting of our just defined options, we need to define derivatives positions. Note that this step is independent from the risk factor model and option model definitions. We only use the market environment data and some additional information needed (e.g. payoff functions).

put = dx.derivatives_position(

name='put',

quantity=2,

underlyings=['gbm_1'],

mar_env=me_opt,

otype='American single',

payoff_func='np.maximum(strike - instrument_values, 0)')

call = dx.derivatives_position(

name='call',

quantity=3,

underlyings=['gbm_2'],

mar_env=me_opt,

otype='European single',

payoff_func='np.maximum(maturity_value - strike, 0)')

Let us define the relevant market by 2 Python dictionaries, the correlation between the two risk factors and a valuation environment.

risk_factors = {'gbm_1': me_1, 'gbm_2' : me_2}

correlations = [['gbm_1', 'gbm_2', -0.4]]

positions = {'put' : put, 'call' : call}

val_env = dx.market_environment('general', dt.datetime(2015, 1, 1))

val_env.add_constant('frequency', 'W')

val_env.add_constant('paths', 50000)

val_env.add_constant('starting_date', val_env.pricing_date)

val_env.add_constant('final_date', val_env.pricing_date)

val_env.add_curve('discount_curve', r)

These are used to define the derivatives portfolio.

port = dx.derivatives_portfolio(

name='portfolio', # name

positions=positions, # derivatives positions

val_env=val_env, # valuation environment

risk_factors=risk_factors, # relevant risk factors

correlations=correlations) # correlation between risk factors

Now, we can get the position values for the portfolio via the get_values method.

port.get_values()

Total pos_value 92.868033 dtype: float64

| position | name | quantity | otype | risk_facts | value | currency | pos_value | |

|---|---|---|---|---|---|---|---|---|

| 0 | put | put | 2 | American single | [gbm_1] | 15.000000 | EUR | 30.000000 |

| 1 | call | call | 3 | European single | [gbm_2] | 20.956011 | EUR | 62.868033 |

Via the get_statistics methods delta and vega values are provided as well.

port.get_statistics()

Totals pos_value 92.8680 pos_delta 0.5512 pos_vega 235.4243 dtype: float64

| position | name | quantity | otype | risk_facts | value | currency | pos_value | pos_delta | pos_vega | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | put | put | 2 | American single | [gbm_1] | 15.000 | EUR | 30.000 | -1.1780 | 92.6000 |

| 1 | call | call | 3 | European single | [gbm_2] | 20.956 | EUR | 62.868 | 1.7292 | 142.8243 |

Having modeled the derivatives portfolio, risk reports are only two method calls away (I).

deltas = port.get_port_risk(Greek='Delta')

dx.risk_report(deltas)

gbm_1_Delta

0.8 0.9 1.0 1.1 1.2

factor 80.00 90.0 100.00 110.00 120.00

value 51.25 42.8 35.96 30.72 26.99

gbm_2_Delta

0.8 0.9 1.0 1.1 1.2

factor 80.00 90.00 100.00 110.00 120.00

value 25.96 30.59 35.96 41.96 48.52

Having modeled the derivatives portfolio, risk reports are only two method calls away (II).

vegas = port.get_port_risk(Greek='Vega', step=0.05)

dx.risk_report(vegas)

gbm_1_Vega

0.80 0.85 0.90 0.95 1.00 1.05 1.10 1.15 1.20

factor 0.16 0.17 0.18 0.19 0.20 0.21 0.22 0.23 0.24

value 34.15 34.60 35.05 35.50 35.96 36.42 36.89 37.35 37.81

gbm_2_Vega

0.80 0.85 0.90 0.95 1.00 1.05 1.10 1.15 1.20

factor 0.40 0.43 0.45 0.48 0.50 0.53 0.55 0.58 0.60

value 31.15 32.36 33.56 34.76 35.96 37.14 38.33 39.50 40.68

A Realistic Example with DX Analytics¶

Bringing back office simulation and risk management practices to front office analytics.

The following more realistic example illustrates that you can model, value and risk manage quite complex derivatives portfolios with DX Analytics. The example has the following characteristics:

- portfolio over 2 years

- stochastic short rate for risk-neutral discounting

- 250 risk factors (gbm, jump diffusion, stochastic volatility)

- 1,000 derivatives (call and put options, European and American exercise, random maturites)

- monthly frequency for discretization

- 1,000 paths for simulation

from dx import *

np.random.seed(10000)

Stochastic Short Rates¶

Let us start by defining a stochastic discounting object (based on CIR square-root diffusion process).

mer = market_environment(name='me', pricing_date=dt.datetime(2015, 1, 1))

mer.add_constant('initial_value', 0.005)

mer.add_constant('volatility', 0.1)

mer.add_constant('kappa', 2.0)

mer.add_constant('theta', 0.03)

mer.add_constant('paths', 1000) # dummy

mer.add_constant('frequency', 'M') # dummy

mer.add_constant('starting_date', mer.pricing_date)

mer.add_constant('final_date', dt.datetime(2015, 12, 31)) # dummy

ssr = stochastic_short_rate('ssr', mer)

Some simulated short rate paths visualized.

plt.figure(figsize=(9, 5))

plt.plot(ssr.process.time_grid, ssr.process.get_instrument_values()[:, :10]);

plt.gcf().autofmt_xdate(); plt.grid()

Multiple Risk Factors¶

The example is based on a multiple, correlated risk factors (based on geomtetric Brownian motion, jump diffusion or stachastic volatility models). The basic assumptions.

# market environments

me = market_environment('gbm', dt.datetime(2015, 1, 1))

# geometric Brownian motion

me.add_constant('initial_value', 36.)

me.add_constant('volatility', 0.2)

me.add_constant('currency', 'EUR')

In addition to the input parameters of the geometric Brownian motion, we also need the following for the jump diffusions and stochastic volatility models.

# jump diffusion

me.add_constant('lambda', 0.4)

me.add_constant('mu', -0.4)

me.add_constant('delta', 0.2)

# stochastic volatility

me.add_constant('kappa', 2.0)

me.add_constant('theta', 0.3)

me.add_constant('vol_vol', 0.5)

me.add_constant('rho', -0.5)

For the portfolio valuation we also need a valuation environment.

# valuation environment

val_env = market_environment('val_env', dt.datetime(2015, 1, 1))

val_env.add_constant('paths', 1000)

val_env.add_constant('frequency', 'M')

val_env.add_curve('discount_curve', r)

val_env.add_constant('starting_date', dt.datetime(2015, 1, 1))

val_env.add_constant('final_date', dt.datetime(2016, 12, 31))

# add valuation environment to market environments

me.add_environment(val_env)

We generate a large number of risk factors (with some random parameter values).

no = 250

risk_factors = {}

for rf in range(no):

# random model choice

sm = np.random.choice(['gbm', 'jd', 'sv'])

key = '%3d_%s' % (rf + 1, sm)

risk_factors[key] = market_environment(key, me.pricing_date)

risk_factors[key].add_environment(me)

# random initial_value

risk_factors[key].add_constant('initial_value',

np.random.random() * 40. + 20.)

# radnom volatility

risk_factors[key].add_constant('volatility',

np.random.random() * 0.6 + 0.05)

# the simulation model to choose

risk_factors[key].add_constant('model', sm)

Correlations are also randomly chosen.

correlations = []

keys = sorted(risk_factors.keys())

for key in keys[1:]:

correlations.append([keys[0], key, np.random.choice([-0.05, 0.0, 0.05])])

correlations[:3]

[[' 1_jd', ' 2_jd', -0.050000000000000003], [' 1_jd', ' 3_sv', 0.050000000000000003], [' 1_jd', ' 4_sv', -0.050000000000000003]]

Options Modeling¶

We model a certain number of derivative instruments with the following major assumptions.

me_option = market_environment('option', me.pricing_date)

# choose from a set of maturity dates (month ends)

maturities = pd.date_range(start=me.pricing_date,

end=val_env.get_constant('final_date'),

freq='M').to_pydatetime()

me_option.add_constant('maturity', np.random.choice(maturities))

me_option.add_constant('currency', 'EUR')

me_option.add_environment(val_env)

Portfolio Modeling¶

The derivatives_portfolio object we compose consists of a large number derivatives positions. Each option differs with respect to the strike and the risk factor it is dependent on.

positions = {}

for i in range(4 * no):

ot = np.random.choice(['am_put', 'eur_call'])

if ot == 'am_put':

otype = 'American single'

payoff_func = 'np.maximum(%5.3f - instrument_values, 0)'

else:

otype = 'European single'

payoff_func = 'np.maximum(maturity_value - %5.3f, 0)'

# random strike

strike = np.random.randint(36, 40)

underlying = sorted(risk_factors.keys())[(i + no) % no]

positions[i] = derivatives_position(

name='option_pos_%d' % strike,

quantity=np.random.randint(1, 10),

underlyings=[underlying],

mar_env=me_option,

otype=otype,

payoff_func=payoff_func % strike)

# number of derivivatives positions

len(positions)

1000

Portfolio Valuation¶

All is together to define the derivatives portfolio.

port_sequ = derivatives_portfolio(

name='portfolio',

positions=positions,

val_env=val_env,

risk_factors=risk_factors,

correlations=correlations,

parallel=False) # sequential calculation

The correlation matrix illstrates the market complexity.

port_sequ.val_env.get_list('correlation_matrix')

| 1_jd | 2_jd | 3_sv | 4_sv | 5_gbm | 6_gbm | 7_jd | 8_gbm | 9_sv | 10_sv | ... | 241_jd | 242_sv | 243_sv | 244_sv | 245_gbm | 246_jd | 247_jd | 248_sv | 249_sv | 250_jd | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1_jd | 1.00 | -0.05 | 0.05 | -0.05 | -0.05 | 0.05 | -0.05 | -0.05 | 0.05 | 0.05 | ... | -0.05 | 0.05 | 0.05 | -0.05 | 0.05 | 0 | 0.05 | 0.05 | 0 | 0 |

| 2_jd | -0.05 | 1.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 3_sv | 0.05 | 0.00 | 1.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 4_sv | -0.05 | 0.00 | 0.00 | 1.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 5_gbm | -0.05 | 0.00 | 0.00 | 0.00 | 1.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 6_gbm | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 7_jd | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 8_gbm | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 9_sv | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 10_sv | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 11_jd | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 12_jd | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 13_jd | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 14_sv | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 15_sv | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 16_jd | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 17_jd | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 18_sv | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 19_sv | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 20_jd | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 21_sv | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 22_gbm | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 23_gbm | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 24_sv | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 25_sv | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 26_jd | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 27_gbm | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 28_gbm | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 29_sv | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 30_sv | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 221_jd | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 222_sv | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 223_gbm | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 224_jd | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 225_jd | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 226_sv | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 227_sv | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 228_jd | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 229_sv | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 230_sv | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 231_gbm | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 232_sv | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 233_gbm | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 234_jd | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 235_gbm | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 236_gbm | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 237_jd | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 238_gbm | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 239_jd | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 240_gbm | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 241_jd | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 1.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 242_sv | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 1.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 243_sv | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 1.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 244_sv | -0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 1.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 245_gbm | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 | 0 | 0.00 | 0.00 | 0 | 0 |

| 246_jd | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1 | 0.00 | 0.00 | 0 | 0 |

| 247_jd | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 1.00 | 0.00 | 0 | 0 |

| 248_sv | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 1.00 | 0 | 0 |

| 249_sv | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 1 | 0 |

| 250_jd | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ... | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0 | 0.00 | 0.00 | 0 | 1 |

250 rows × 250 columns

The call of the get_values method to value all instruments.

%time res = port_sequ.get_statistics(fixed_seed=True)

Totals pos_value 47818.6880 pos_delta 633.1349 pos_vega 45994.4110 dtype: float64 CPU times: user 16min 58s, sys: 1min 31s, total: 18min 29s Wall time: 9min 33s

The resulting table with the results.

res.set_index('position', inplace=False)

| name | quantity | otype | risk_facts | value | currency | pos_value | pos_delta | pos_vega | |

|---|---|---|---|---|---|---|---|---|---|

| position | |||||||||

| 0 | option_pos_36 | 1 | American single | [ 1_jd] | 14.017 | EUR | 14.017 | -0.6000 | 14.8000 |

| 1 | option_pos_37 | 3 | European single | [ 2_jd] | 7.614 | EUR | 22.842 | 1.8135 | 42.2193 |

| 2 | option_pos_39 | 8 | American single | [ 3_sv] | 5.553 | EUR | 44.424 | -1.2128 | 36.2088 |

| 3 | option_pos_36 | 3 | American single | [ 4_sv] | 9.766 | EUR | 29.298 | -1.4400 | 18.0000 |

| 4 | option_pos_37 | 1 | American single | [ 5_gbm] | 5.145 | EUR | 5.145 | -0.3270 | 20.5000 |

| 5 | option_pos_36 | 5 | European single | [ 6_gbm] | 7.660 | EUR | 38.300 | 3.1240 | 90.8225 |

| 6 | option_pos_38 | 8 | European single | [ 7_jd] | 7.889 | EUR | 63.112 | 5.3640 | 119.1528 |

| 7 | option_pos_37 | 5 | American single | [ 8_gbm] | 7.483 | EUR | 37.415 | -1.4570 | 84.5000 |

| 8 | option_pos_36 | 8 | European single | [ 9_sv] | 1.524 | EUR | 12.192 | 2.2024 | 11.8104 |

| 9 | option_pos_37 | 1 | American single | [ 10_sv] | 7.063 | EUR | 7.063 | -0.2703 | -0.9000 |

| 10 | option_pos_39 | 2 | European single | [ 11_jd] | 7.743 | EUR | 15.486 | 1.2608 | 33.7394 |

| 11 | option_pos_38 | 2 | European single | [ 12_jd] | 19.152 | EUR | 38.304 | 1.8222 | 5.5712 |

| 12 | option_pos_36 | 2 | European single | [ 13_jd] | 8.983 | EUR | 17.966 | 1.2834 | 32.6318 |

| 13 | option_pos_38 | 4 | American single | [ 14_sv] | 12.286 | EUR | 49.144 | -1.3168 | 11.6000 |

| 14 | option_pos_39 | 4 | American single | [ 15_sv] | 8.352 | EUR | 33.408 | -1.1064 | 7.6000 |

| 15 | option_pos_37 | 9 | European single | [ 16_jd] | 24.621 | EUR | 221.589 | 7.2540 | 144.0027 |

| 16 | option_pos_39 | 4 | American single | [ 17_jd] | 10.497 | EUR | 41.988 | -1.0556 | 77.2368 |

| 17 | option_pos_39 | 9 | European single | [ 18_sv] | 17.148 | EUR | 154.332 | 7.0758 | 19.3392 |

| 18 | option_pos_39 | 2 | American single | [ 19_sv] | 5.067 | EUR | 10.134 | -0.2970 | 9.1704 |

| 19 | option_pos_38 | 4 | European single | [ 20_jd] | 19.272 | EUR | 77.088 | 3.4180 | 40.5884 |

| 20 | option_pos_36 | 5 | European single | [ 21_sv] | 25.646 | EUR | 128.230 | 4.4240 | 3.1845 |

| 21 | option_pos_38 | 2 | American single | [ 22_gbm] | 8.404 | EUR | 16.808 | -0.2818 | 42.7032 |

| 22 | option_pos_36 | 7 | American single | [ 23_gbm] | 0.000 | EUR | 0.000 | 0.0000 | 0.0000 |

| 23 | option_pos_37 | 4 | European single | [ 24_sv] | 1.920 | EUR | 7.680 | 1.2920 | 1.4212 |

| 24 | option_pos_38 | 9 | American single | [ 25_sv] | 6.587 | EUR | 59.283 | -2.1663 | 18.0000 |

| 25 | option_pos_38 | 2 | European single | [ 26_jd] | 4.173 | EUR | 8.346 | 1.3576 | 13.6942 |

| 26 | option_pos_37 | 8 | American single | [ 27_gbm] | 7.373 | EUR | 58.984 | -6.5768 | 139.2000 |

| 27 | option_pos_39 | 4 | American single | [ 28_gbm] | 13.565 | EUR | 54.260 | -2.6512 | 59.6000 |

| 28 | option_pos_37 | 3 | European single | [ 29_sv] | 24.181 | EUR | 72.543 | 2.5482 | 8.4126 |

| 29 | option_pos_39 | 9 | European single | [ 30_sv] | 0.974 | EUR | 8.766 | 1.6641 | 7.1325 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 970 | option_pos_39 | 5 | American single | [221_jd] | 8.319 | EUR | 41.595 | -1.5370 | 82.5000 |

| 971 | option_pos_37 | 7 | American single | [222_sv] | 5.185 | EUR | 36.295 | -0.9555 | 15.4000 |

| 972 | option_pos_38 | 3 | European single | [223_gbm] | 12.073 | EUR | 36.219 | 2.3721 | 54.3414 |

| 973 | option_pos_39 | 9 | European single | [224_jd] | 2.608 | EUR | 23.472 | 3.3786 | 97.9479 |

| 974 | option_pos_36 | 1 | American single | [225_jd] | 8.337 | EUR | 8.337 | -0.4035 | 14.4000 |

| 975 | option_pos_39 | 3 | American single | [226_sv] | 16.553 | EUR | 49.659 | -0.6471 | -18.6000 |

| 976 | option_pos_37 | 4 | American single | [227_sv] | 5.536 | EUR | 22.144 | -0.7632 | 18.4000 |

| 977 | option_pos_38 | 6 | American single | [228_jd] | 6.633 | EUR | 39.798 | -1.7490 | 79.2000 |

| 978 | option_pos_38 | 3 | American single | [229_sv] | 5.359 | EUR | 16.077 | -0.6081 | 5.0481 |

| 979 | option_pos_39 | 9 | European single | [230_sv] | 7.564 | EUR | 68.076 | 5.4657 | 27.8739 |

| 980 | option_pos_38 | 8 | European single | [231_gbm] | 12.054 | EUR | 96.432 | 7.3864 | 84.1928 |

| 981 | option_pos_36 | 4 | American single | [232_sv] | 3.858 | EUR | 15.432 | -0.8972 | 14.0000 |

| 982 | option_pos_39 | 8 | American single | [233_gbm] | 6.920 | EUR | 55.360 | -3.4248 | 176.8000 |

| 983 | option_pos_38 | 7 | American single | [234_jd] | 18.878 | EUR | 132.146 | -4.9469 | 39.2000 |

| 984 | option_pos_37 | 9 | European single | [235_gbm] | 17.168 | EUR | 154.512 | 8.9217 | 11.8746 |

| 985 | option_pos_38 | 5 | American single | [236_gbm] | 18.892 | EUR | 94.460 | -2.4340 | 74.6360 |

| 986 | option_pos_38 | 3 | European single | [237_jd] | 9.499 | EUR | 28.497 | 2.1438 | 36.3903 |

| 987 | option_pos_36 | 4 | American single | [238_gbm] | 0.068 | EUR | 0.272 | -0.0504 | 15.2000 |

| 988 | option_pos_38 | 8 | American single | [239_jd] | 1.927 | EUR | 15.416 | -0.2880 | 50.4000 |

| 989 | option_pos_37 | 3 | European single | [240_gbm] | 11.243 | EUR | 33.729 | 2.1039 | 59.7411 |

| 990 | option_pos_36 | 7 | European single | [241_jd] | 5.854 | EUR | 40.978 | 4.9770 | 59.3271 |

| 991 | option_pos_37 | 6 | American single | [242_sv] | 17.708 | EUR | 106.248 | -3.1770 | -26.4000 |

| 992 | option_pos_38 | 4 | European single | [243_sv] | 9.336 | EUR | 37.344 | 2.5724 | 13.1680 |

| 993 | option_pos_39 | 9 | European single | [244_sv] | 8.799 | EUR | 79.191 | 5.7591 | 15.1164 |

| 994 | option_pos_37 | 7 | European single | [245_gbm] | 17.538 | EUR | 122.766 | 5.5377 | 149.1252 |

| 995 | option_pos_36 | 9 | American single | [246_jd] | 1.896 | EUR | 17.064 | -1.0944 | 134.1000 |

| 996 | option_pos_37 | 9 | European single | [247_jd] | 12.250 | EUR | 110.250 | 6.3801 | 148.0761 |

| 997 | option_pos_37 | 5 | American single | [248_sv] | 4.309 | EUR | 21.545 | -0.9470 | 9.5000 |

| 998 | option_pos_37 | 3 | European single | [249_sv] | 4.663 | EUR | 13.989 | 1.5225 | 8.1852 |

| 999 | option_pos_37 | 8 | American single | [250_jd] | 10.327 | EUR | 82.616 | -2.0448 | 109.2584 |

1000 rows × 9 columns

Risk Analysis¶

Full distribution of portfolio present values illustrated via histogram.

%time pvs = port_sequ.get_present_values()

CPU times: user 4min 22s, sys: 15.8 s, total: 4min 38s Wall time: 2min 23s

plt.figure(figsize=(9, 6)); plt.hist(pvs, bins=30);

plt.xlabel('portfolio present values');plt.ylabel('frequency'); plt.grid()

Some statistics via pandas.

pdf = pd.DataFrame(pvs, columns=['values'])

pdf.describe()

| values | |

|---|---|

| count | 1000.000000 |

| mean | 47858.798330 |

| std | 3885.104955 |

| min | 38795.659239 |

| 25% | 45115.795320 |

| 50% | 47705.269666 |

| 75% | 50224.427169 |

| max | 65496.998373 |

The delta risk (sensitivities) report.

%%time

deltas = port_sequ.get_port_risk(Greek='Delta', fixed_seed=True, step=0.2,

risk_factors=risk_factors.keys()[:4])

risk_report(deltas)

39_jd_Delta

0.8 1.0 1.2

factor 37.52 46.91 56.29

value 9482.22 9508.99 9537.94

107_sv_Delta

0.8 1.0 1.2

factor 24.43 30.54 36.65

value 9513.48 9504.40 9499.51

144_sv_Delta

0.8 1.0 1.2

factor 21.36 26.7 32.04

value 9502.22 9504.4 9509.62

246_jd_Delta

0.8 1.0 1.2

factor 44.73 55.91 67.09

value 9504.39 9507.45 9515.13

CPU times: user 55.9 s, sys: 473 ms, total: 56.4 s

Wall time: 54.4 s

The vega risk (sensitivities) report.

%%time

vegas = port_sequ.get_port_risk(Greek='Vega', fixed_seed=True, step=0.2,

risk_factors=risk_factors.keys()[:4])

risk_report(vegas)

39_jd_Vega

0.8 1.0 1.2

factor 0.49 0.61 0.73

value 9499.56 9507.45 9514.95

107_sv_Vega

0.8 1.0 1.2

factor 0.28 0.35 0.42

value 9506.97 9507.45 9508.34

144_sv_Vega

0.8 1.0 1.2

factor 0.50 0.62 0.75

value 9506.33 9507.45 9508.86

246_jd_Vega

0.8 1.0 1.2

factor 0.21 0.26 0.32

value 9505.67 9507.45 9510.28

CPU times: user 56.8 s, sys: 520 ms, total: 57.3 s

Wall time: 55.3 s

Visualization of Selected Results¶

Selected results visualized.

res[['pos_value', 'pos_delta', 'pos_vega']].hist(bins=30, figsize=(9, 6))

plt.ylabel('frequency')

<matplotlib.text.Text at 0x117bfbc90>

Sample paths for three underlyings.

paths_0 = port_sequ.underlying_objects.values()[0]

paths_0.generate_paths()

paths_1 = port_sequ.underlying_objects.values()[1]

paths_1.generate_paths()

paths_2 = port_sequ.underlying_objects.values()[2]

paths_2.generate_paths()

An the resulting plot.

pa = 5; plt.figure(figsize=(10, 6))

plt.plot(port_sequ.time_grid, paths_0.instrument_values[:, :pa], 'b');

plt.plot(port_sequ.time_grid, paths_1.instrument_values[:, :pa], 'r.-');

plt.plot(port_sequ.time_grid, paths_2.instrument_values[:, :pa], 'g-.', lw=2.5);

print 'Paths for %s (blue)' % paths_0.name

print 'Paths for %s (red)' % paths_1.name

print 'Paths for %s (green)' % paths_2.name; plt.grid()

plt.ylabel('risk factor level'); plt.gcf().autofmt_xdate()

Paths for 107_sv (blue) Paths for 144_sv (red) Paths for 39_jd (green)

Books¶

By others:

- Python for Financial Modelling @ Wiley Finance (2009)

- Python for Finance @ Packt Publishing (2014)

By myself:

- Python for Finance – Analyze Big Financial Data @ O'Reilly (2014)

- Derivatives Analytics with Python @ Wiley Finance (2015)

Available as ebook and from December 2015 as print version.

Forthcoming 2015 at Wiley Finance ...

Meetups¶

For Python Quants Conference¶

- 1st conference in New York City on 14. March 2014

- 2nd conference in London on 28. November 2014

- 3rd conference planned for QI 2015 in Asia (eg Shanghai)

from IPython.display import HTML

HTML('<iframe src="http://forpythonquants.com" \

width=100% height=650></iframe>')

Final Thoughts¶

My wish for Python in the future: to become THE glue language and platform for

- data analytics

- financial analytics (derivatives, risk)

- development efforts in general

- performance technologies

- science and the technology world

- ...

Contact us¶

Please contact us if you have any questions or want to get involved in our Python community events.

Python Quant Platform | http://quant-platform.com

Derivatives Analytics with Python | Derivatives Analytics @ Wiley Finance

Python for Finance | Python for Finance @ O'Reilly