Python and the Financial Community¶

A Subjective and Biased Overview

The Python Language¶

Black-Scholes-Merton (1973) SDE of geometric Brownian motion.

$$ dS_t = rS_tdt + \sigma S_t dZ_t $$

Monte Carlo simulation: draw $I$ standard normally distributed random number $z_t^i$ and apply them to the following by Euler disctretization scheme to simulate $I$ end values of the GBM:

$$ S_{T} = S_0 \exp \left(\left( r - \frac{1}{2} \sigma^2\right) T + \sigma \sqrt{T} z_T \right) $$

Latex description of Euler discretization.

S_T = S_0 \exp (( r - 0.5 \sigma^2 ) T + \sigma \sqrt{T} z_T)

Python implementation of algorithm.

from pylab import *

S0 = 100.; r = 0.01; T = 0.5; sigma = 0.2

ST = S0 * exp((r - 0.5 * sigma ** 2) * T

+ sigma * sqrt(T) * standard_normal(10000))

Interactive visualization of simulation results.

%matplotlib inline

hist(ST, bins=40);

grid(True)

The Python Ecosystem¶

- IPython (Notebook)

- NumPy (fast, vectorized array operations)

- SciPy (collection of scientific classes/functions)

- pandas (times series and tabular data)

- PyTables (hardware-bound IO operations)

- scikit-learn (machine learning algorithms)

- statsmodels (statistical classes/functions)

- xlwings (Python-Excel integration)

Financial Libraries¶

By others:

- zipline (backtesting of trading algos)

- matplotlib.finance (financial plots)

- Python wrappers (QuantLib)

By us:

- DEXISION – GUI-based financial engineering

- DX Analytics – global valuation of multi-risk derivatives and portfolios

APIs¶

- OANDA (fx trading platform)

- Thomson Reuters (wrapper for unified API in the making)

- ...

Integration¶

- C/C++ (natively)

- Julia (IPython)

- JavaScript (IPython)

- R (IPython/rpy2)

- Matlab (NumPy)

- ...

Pushing data from Python to R.

%load_ext rpy2.ipython

X = arange(100)

Y = 2 * X + 5 + 2 * standard_normal(len(X))

%Rpush X Y

Generating plots with R.

%R plot(X, Y, pch=19, col='blue'); grid(); title("R Plot with IPython")

Doing statistics in R.

%R print(summary(lm(Y~X)))

Call:

lm(formula = Y ~ X)

Residuals:

Min 1Q Median 3Q Max

-4.6160 -1.3221 0.0707 1.2701 5.5099

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 4.973043 0.415827 11.96 <2e-16 ***

X 2.000921 0.007257 275.73 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 2.095 on 98 degrees of freedom

Multiple R-squared: 0.9987, Adjusted R-squared: 0.9987

F-statistic: 7.603e+04 on 1 and 98 DF, p-value: < 2.2e-16

Pulling data from R to Python.

%R c = coef(lm(Y~X))

%Rpull c

c

<FloatVector - Python:0x10b211b90 / R:0x1017576a8> [4.973043, 2.000921]

Performance¶

Finance algorithms are loop-heavy; Python loops are slow; Python is too slow for finance.

def counting_py(N):

s = 0

for i in xrange(N):

for j in xrange(N):

s += int(cos(log(1)))

return s

N = 2000

%time counting_py(N)

# memory efficient but slow

CPU times: user 19 s, sys: 18.7 ms, total: 19.1 s Wall time: 19.1 s

4000000

First approach: vectorization with NumPy.

%%time

arr = ones((N, N))

print int(sum(cos(log(arr))))

# much faster but NOT memory efficient

4000000 CPU times: user 96.6 ms, sys: 54.9 ms, total: 151 ms Wall time: 153 ms

arr.nbytes

32000000

Second approach: dynamic compiling with Numba.

import numba

counting_nb = numba.jit(counting_py)

%time counting_nb(N)

CPU times: user 152 ms, sys: 23.6 ms, total: 176 ms Wall time: 220 ms

4000000

%timeit counting_nb(N)

# even faster AND memory efficient

10 loops, best of 3: 54.5 ms per loop

Hardware-bound IO operations are standard for Python.

arr = standard_normal((12500, 10000))

arr.nbytes

# a giga byte worth of data

1000000000

%time save('data', arr)

CPU times: user 55.1 ms, sys: 1.85 s, total: 1.91 s Wall time: 2.35 s

!ls -n data*

-rw-r--r-- 1 501 20 1000000080 22 Sep 16:14 data.npy

!rm data*

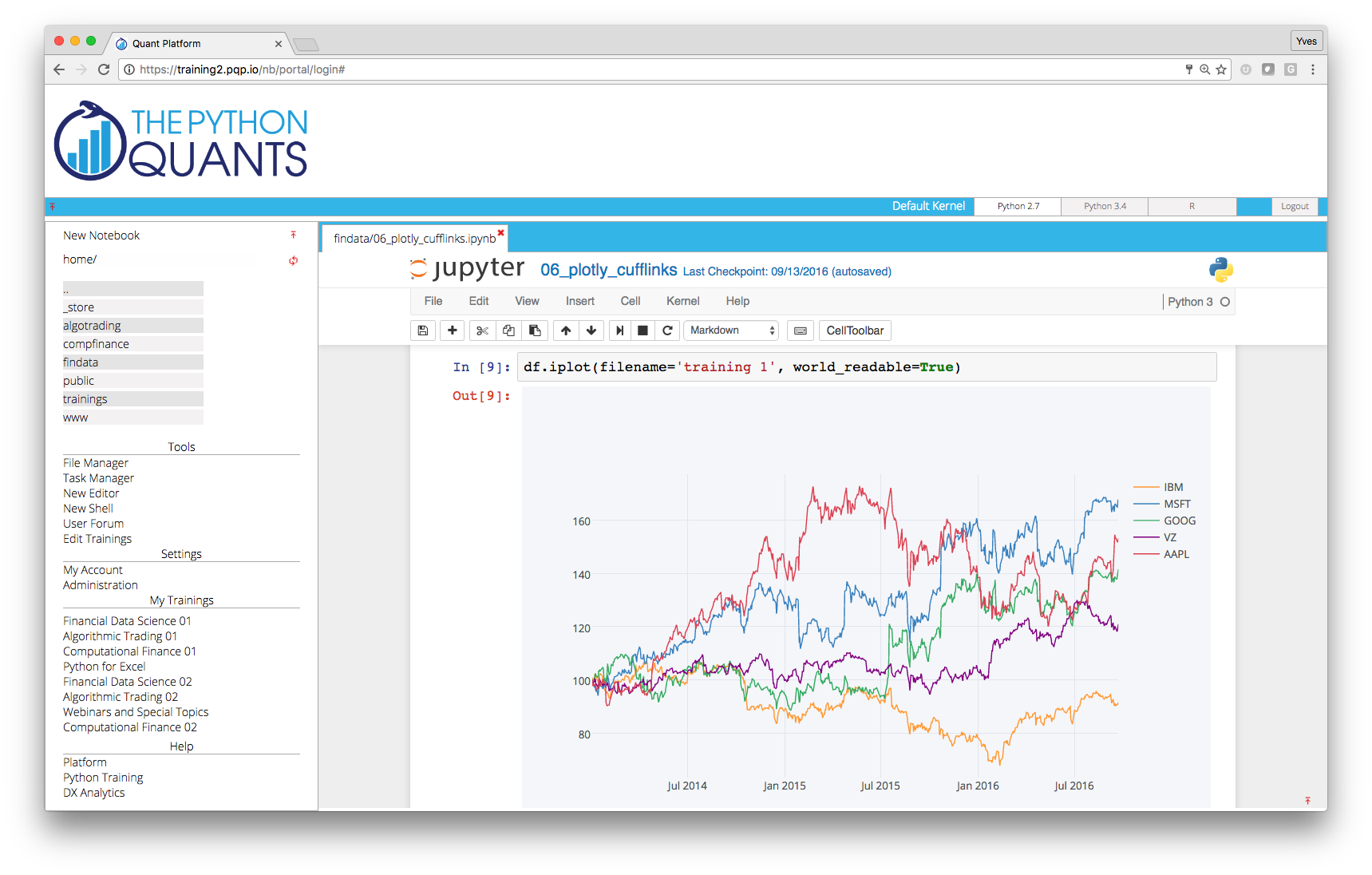

Python Quant Platform¶

Integrating it all and adding collaboration and scalability (http://quant-platform.com).

The Large Banks¶

- Bank of America Merill Lynch (Quartz platform)

- JPMorgan Chase (Athena platform)

- ...

The Hedge Funds¶

- AQR Capital Management (origin of pandas)

- Two Sigma Investments (large scale data analytics)

- ARC Investments (full-fledged Python for vol trading)

- ...

Innovators in the Space¶

- Quantopian (algo trading & backtesting)

- Washington Square Technologies (trade & risk platform)

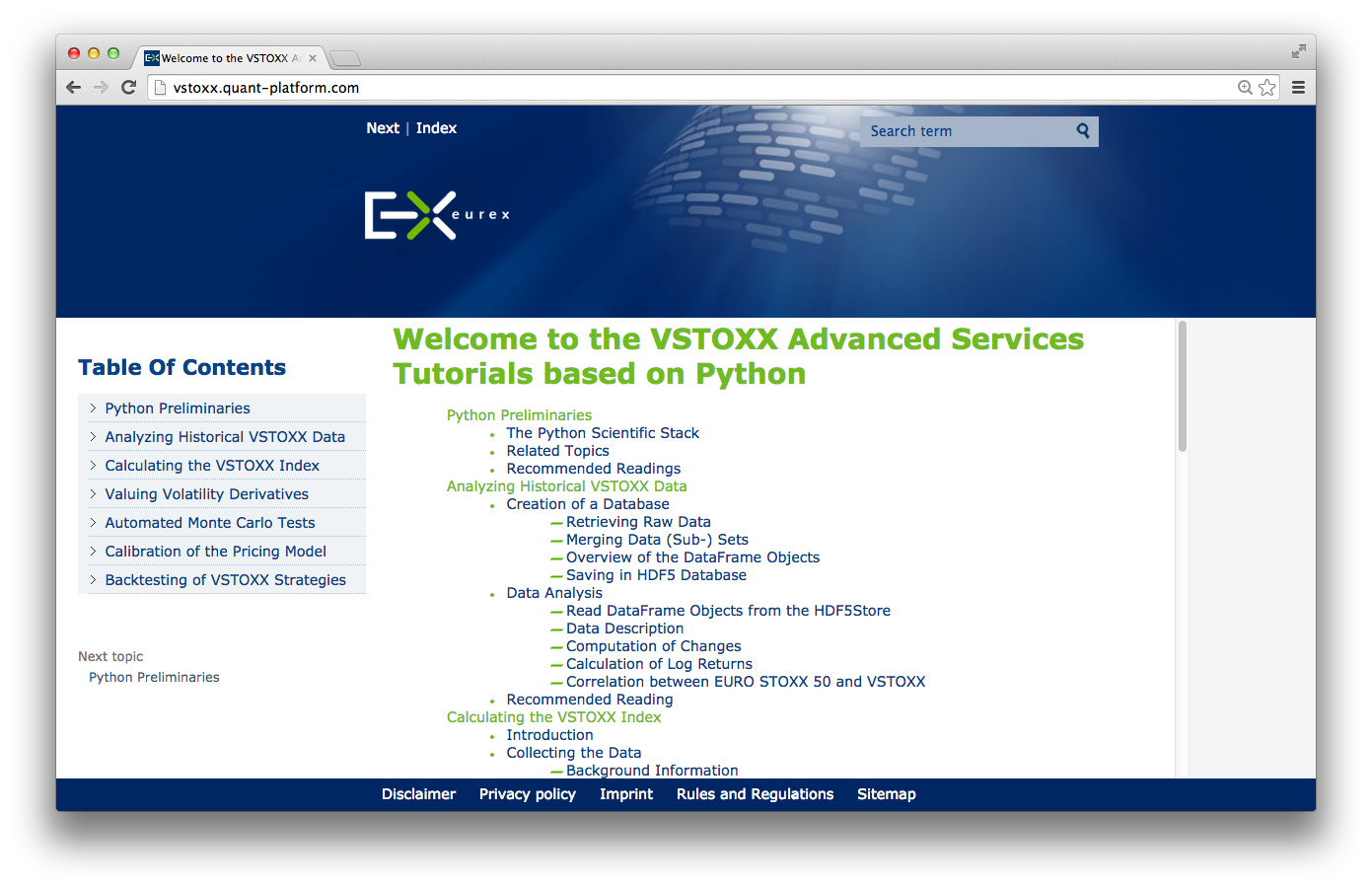

- Deutsche Boerse/Eurex (VSTOXX and Variance Advanced Services)

- ...

Python-based tutorials by Eurex (http://www.eurexchange.com/vstoxx/).

Books¶

By others:

- Python for Financial Modelling @ Wiley Finance (2009)

- Python for Finance @ Packt Publishing (2014)

By myself:

- Python for Finance – Analyze Big Financial Data @ O'Reilly (2014)

- Derivatives Analytics with Python @ Wiley Finance (2015)

Integrated offering: book + notebooks + platform + training + ...

Financial Research¶

"The appendices present an implementation in Python of our experiments." (p. 3)

Education¶

- Master of Financial Engineering @ Baruch College CUNY

- Master of Data Science @ City University of New York

- Numerical Option Pricing with Python @ Saarland University

- ...

"Knowledge and Skills: Our graduates have working experience with C++, VBA, Python, R, and Matlab for financial applications. They share an exceptionally strong work ethic and possess excellent interpersonal, teamwork, and communication skills."

Training¶

By others:

- Python for Finance @ Continuum Analytics

- Python for Finance @ Enthought

By myself:

- Python for Quant Finance @ Python for Quant Finance Meetup Group

- Python for Finance @ http://quantshub.com

- NumPy & pandas for Finance @ CQF Institute/Fitch Learnings

- ...

Meetups¶

For Python Quants Conference¶

- 1st conference in New York City on 14. March 2014

- 2nd conference in London on 28. November 2014

- 3rd conference planned for QI 2015 in Asia (eg Shanghai)

Contact us¶

Please contact us if you have any questions or want to get involved in our Python community events.

Python Quant Platform | http://quant-platform.com

Derivatives Analytics with Python | Derivatives Analytics @ Wiley Finance

Python for Finance | Python for Finance @ O'Reilly